Are you a business owner operating in the world of e-commerce and feeling overwhelmed by all the financial aspects that your company has to face? Bookkeeping is one of the most important factors in the success of an online store. It accurately tracks the total amount of sales, all payments made, expenditures incurred and taxes due. When it comes to accounting reports, filing tax returns at the end of each year and keeping track of cash flow, bookkeeping is highly beneficial.

Successful ecommerce businesses require more than just good products and great marketing strategies. Finance management is vital to ensuring compliance and profitability. This article will discuss the most essential aspects of ecommerce finance that include bookkeeping, accounting, as well as tax preparation. Understanding and mastering the elements of e-commerce is critical to long-term growth and success.

Bookkeeping is a crucial aspect of the financial management of ecommerce companies. Bookkeeping involves organizing and recording financial transactions, such as expenses and sales. By keeping up-to-date and accurate data, entrepreneurs of e-commerce gain valuable insights into their business’s financial performance. With accurate records, entrepreneurs in the e-commerce industry can track their cash flow, sales and expenses and take informed business decisions. For more information, click accounting

Effective bookkeeping practices are crucial for ecommerce businesses of all sizes. Here are some key strategies to simplify your bookkeeping process:

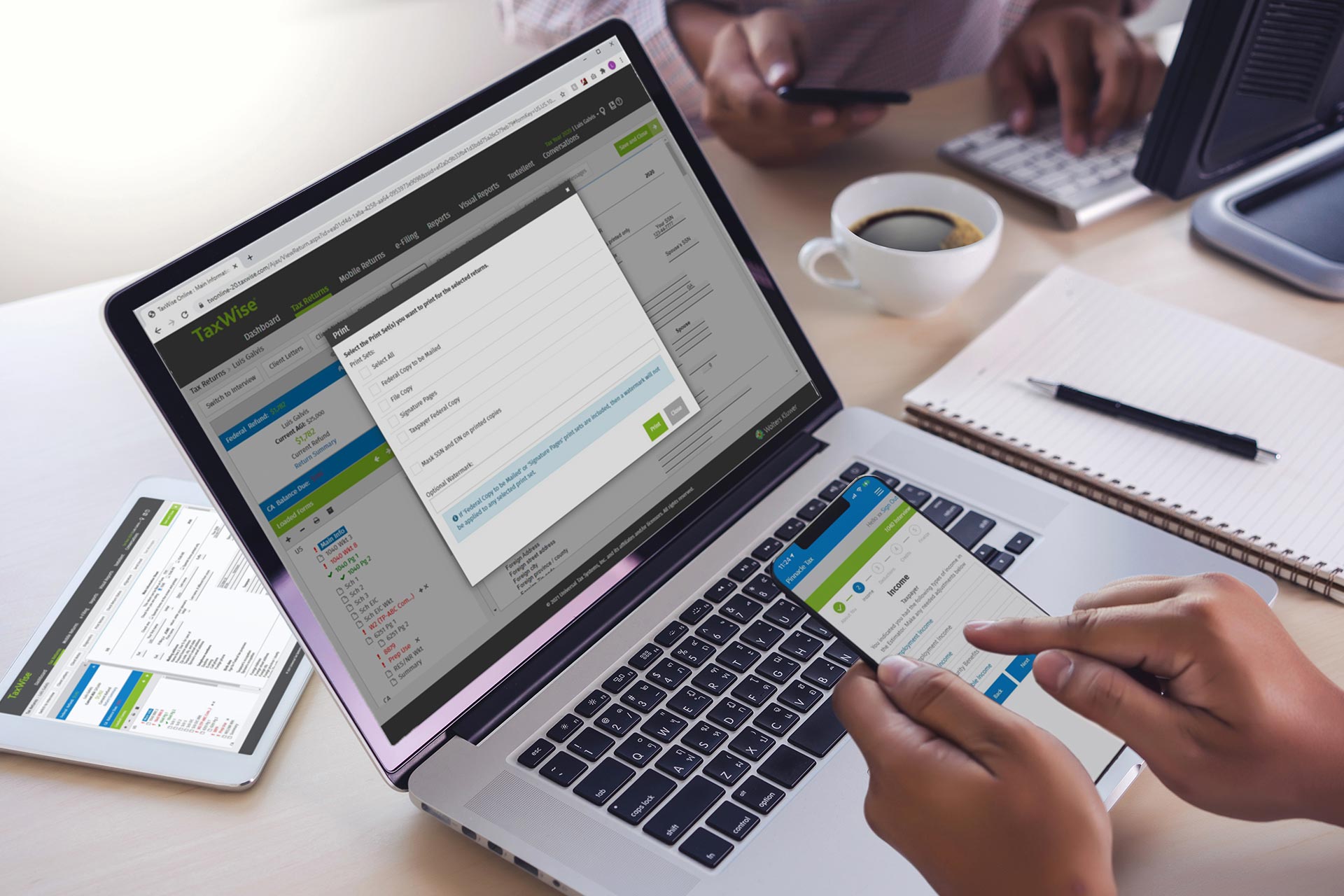

Make use of accounting Software Get a reliable accounting software designed specifically for companies that operate on e-commerce. These tools automate data input produces reports, and allow integration with payment gateways, eCommerce platforms and ecommerce platforms.

Separate your personal finances from the ones of your business. It is important to separate credit cards, bank accounts and debit cards. This will simplify the bookkeeping process, eases tax filing, and helps ensure precise reports.

Sort transactions into categories: By precisely classifying your transactions you can better understand your revenue streams. Make categories for advertising costs shipping costs, as well as other expense types.

Tax preparation plays an essential aspect in the financial management of ecommerce. E-commerce companies are required to conform to tax regulations as well as collect and pay the sales tax, if appropriate. Additionally, they must submit tax returns in a timely manner. Here are some considerations to ensure tax preparation is efficient:

Sales Tax Compliance: Be aware of the tax laws of the states where you offer your products. Find out if you have an nexus (a substantial presence) in these states and whether you need to collect and pay sales tax.

Keep Detailed Records: Maintain meticulous records of your expenses, sales and tax-related transactions. Keep track of any deductions or exemptions you could be entitled to.

Speak with a tax professional Taxes on ecommerce can be a bit complicated. Consider consulting a tax professional who specializes in ecommerce businesses to ensure accurate and compliant tax preparation.

Accounting goes far beyond bookkeeping and tax preparation. Accounting involves analysing financial data in the form of financial statements as well as providing an overall view of the financial performance of your ecommerce company. The following are the reasons why accounting is important:

Financial Analysis: Accounting enables you to gauge your company’s profitability, identify trends and make educated decisions regarding growth.

Budgeting and forecasting can help to set financial goals and forecast the future performance. You can plan effectively and allocate resources if you follow this.

Financial Reporting: Producing financial statements, like income statements, balance sheets, and cash flow statements, lets you reveal your business’s financial status to investors, stakeholders, and lenders.

When your business’s online presence expands, managing complex financial tasks can become too much. Outsourcing bookkeeping and accounting services can provide several benefits for your business, such as:

Expertise and accuracy Accuracy and expertise: Professional accountants, bookkeepers and other financial experts are experts in the field of e-commerce finance. They can ensure that your financial records are accurate. documents and financial statements.

Outsourcing can save you both time and cash. You can concentrate on your primary business concerns while experts handle the finances. This can be a more affordable option than hiring employees internally.

The profitability of your online store can be increased if you have a reliable bookkeeping system in place. Although it can be lengthy and daunting to create a bookkeeping system which allows you to keep track of your expenditure. It also provides valuable insight on areas that could be improved in efficiency or boost sales. Professional accounting services can help in the creation of a bookkeeping system to help your business get in the direction of success. Get in touch with a professional like this when you’re overwhelmed or do not have enough resources. The process could lead to a whole new realm of possibilities that can boost your company’s performance in numerous ways now as well as over time. Why put off? Make use of these tools to boost the earnings of your business.